Jackson Hole, whyHours after Federal Reserve Chair Jerome Powell suggested that the Fed may soon cut interest rates, the Dow Jones Industrial Average set a record high on Friday for the first time this year.

The Dow reached an all-time high of 45,631.74 after rising 846 points, or 1.89%, from Thursday’s close.

In 2025, the tech-heavy Nasdaq and the widely diversified S&P 500 both hit over 15 new highs.

Powell’s live streamed speech at an economic symposium in Jackson Hole, Wyoming, on Friday, where he discussed the economic circumstances facing the Fed and Americans, was watched by investors nationwide. According to Powell, the numbers suggest that a difficult situation is likely to arise from growing inflation and declining employment.

Our framework requires us to balance both sides of our dual mandate, which he defined as [fostering] maximum employment and stable pricing for the American people, when our goals are in conflict like this.

However, he continued to argue that a reassessment of the Fed’s policy position, which hasn’t decreased interest rates since December, was necessary after citing certain good aspects of the current status of the American economy.

However, the baseline forecast and the changing risk balance may call for changing our policy position, he continued, since policy is in restrictive zone.

Powell’s comments have been interpreted by many as suggesting that the Fed may lower interest rates at its September meeting, as it usually does to boost a faltering economy.

Reduced interest rates promote borrowing and spending, which can increase investor confidence and business profitability while frequently bolstering stock market expansion.

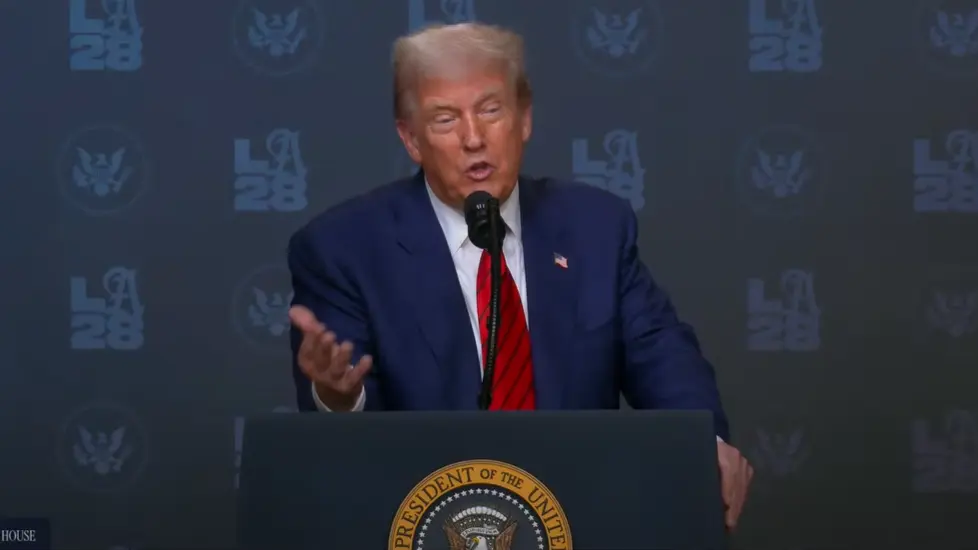

Powell told listeners Friday that if the Fed lowers interest rates, it will be because it is the appropriate course of action based on the data and not due to political pressure, despite months of demand from President Donald Trump to do so.

Only their evaluation of the information and its implications for the economic outlook and risk balance will inform the Federal Open Market Committee members’ judgments. He declared that we will never stray from that strategy.