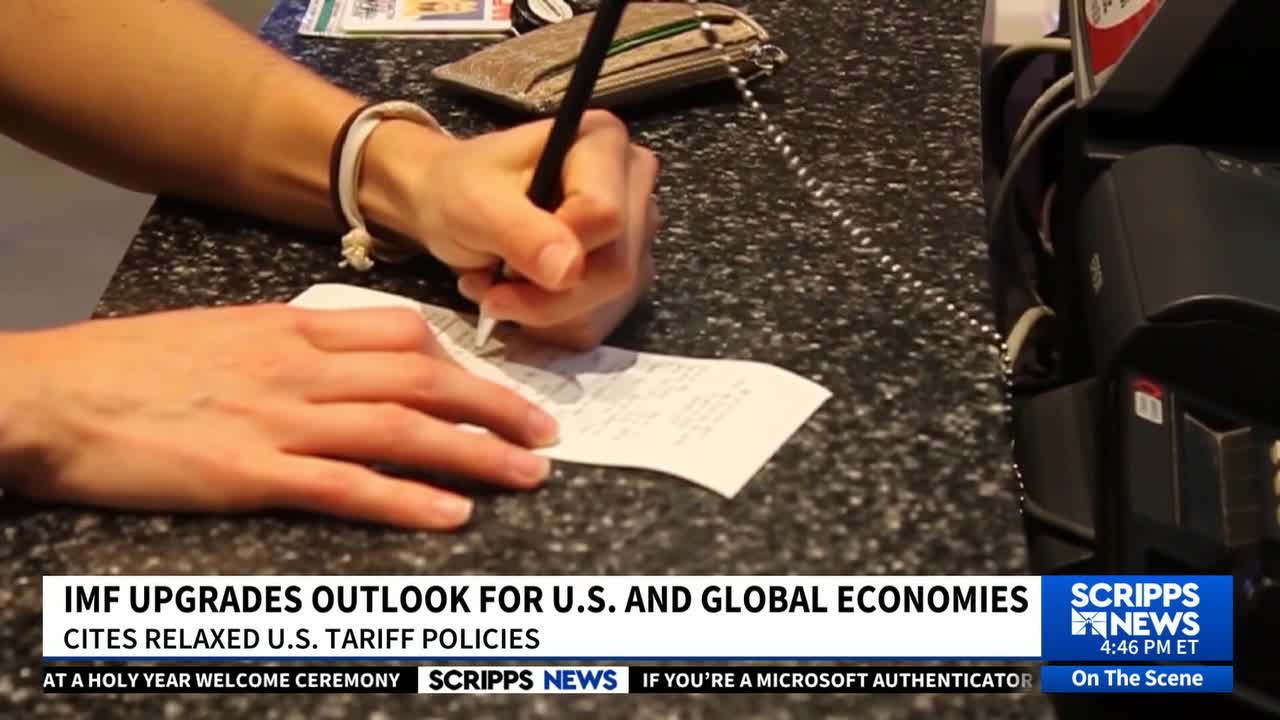

IMF upgrades economic outlook and US consumer sentiment improves

On Tuesday, the International Monetary Fund released a fresh assessment on the prognosis for the global economy along with a series of new economic indicators.

The report and new data provide new information about the status of the world and U.S. economies.

The IMF delivers its outlook for the world economy.

In a new research published Tuesday, the International Monetary Fund predicted 3% worldwide economic growth in 2025.

Although that estimate is lower than the 3.3% increase in 2024, it is still better than the 2.8% growth it had predicted for the year in April, just after President Donald Trump first declared broad tariffs.

Additionally, the IMF raised its forecast for this year’s 1.9% growth in the U.S. economy. Although it is better than the 1.8% predicted earlier this year, it is still lower than the 2.8% from the previous year.

“Tenuous Resilience Amid Persistent Uncertainty” is the title of the IMF’s report, which also stated that President Trump’s relaxation of some previously proposed tariff policies allayed concerns about an economic depression.

Pierre-Olivier Gourinchas, chief economist at the IMF, stated that “this modest decline in trade tensions, however fragile, has contributed to the resilience of the global economy so far.”

India’s GDP is anticipated to expand 6.4% this year, while China’s is likely to rise 4.8%.

Additionally, the IMF increased its forecast for global trade growth to 2.6% for the year. That is up almost as much from April but down almost a full point from the previous year. However, with the IMF predicting only 1.9% increase in trade in 2026, tariffs are expected to have a greater influence on trade next year.

Consumer confidence in the US marginally increases

The economy is slightly improving for American consumers.

According to new statistics released Tuesday, the Conference Board’s consumer confidence index increased by two points to 97.2 in July from 95.2 in June.

Customers’ perceptions of their present financial circumstances somewhat declined.

According to the Conference Board, consumers are apprehensive about tariffs and fear that they would raise prices.

Jonathan Ernest, an assistant professor of economics at Case Western University, said that although the specifics of certain planned tariffs are still unknown, they are nevertheless a source of worry.

“People are very concerned that the products they like to buy might go up in price in the very near future and then (they’re) breathing somewhat of a sigh of relief knowing that those prices might not rise quite as high as these tariff deals are announced,” Ernest stated.

Numbers for consumer confidence remain far lower than they were at the conclusion of the previous year.

U.S. job vacancies decline

In June, 7.4 million job openings were posted by employers, according to the Labor Department.

Compared to 7.7 million in May, that was less.

Ernest claims that while the June number indicates a “relatively stable” market, the fact that there are fewer job opportunities does not necessarily mean that people are finding work more quickly.

He claims that because of the uncertainty brought on by tariffs, businesses are still reluctant to hire.

“There’s still some indecision in the air in terms of where policies are going, where tariffs are going,” he stated. “Some institutions, in my opinion, are a little slow to enter, hire, and integrate new members. They want a little more confidence and to see where things are headed.